Financial Literacy Made Simple: Students Take Charge

Newz Daddy Educational Updates

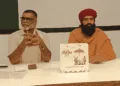

At the campus of Swarrnim Science College under Swarrnim Startup & Innovation University near Adalaj, Gandhinagar, a guest lecture on financial literacy recently took place for undergraduate students in semesters I, III, and V. Seventy-three students attended and actively participated. The session was conducted by the State Bank of India’s Financial Literacy & Credit Counselling Centre in Gandhinagar, and led by Mr Anil Purohit, counsellor at that centre.

The event’s main aim was to help the students gain a clearer understanding of how banks work, how to manage money responsibly, and how to use digital financial services safely. This matters because many young people now rely on online payments, mobile banking and digital transactions, and research shows that without proper knowledge, people are at risk of fraud or misuse. For example, studies in India highlight that higher digital financial literacy leads to better use of digital payments and stronger financial management.

During the lecture, the speaker explained the variety of bank account types young people might use. He also described digital payment systems and online banking services. These explanations are timely because the Indian banking sector and regulators emphasise financial literacy as a key pillar of inclusion. For instance, authorities define financial literacy as the ability to understand and use financial tools to make informed decisions — covering budgeting, saving, credit management and planning.

Mr Purohit used real-life case studies to bring the message home. He showed how everyday digital payments carry risks, for example, phishing scams, SIM-swap fraud or unauthorised transactions. Research illustrates that in India, as digital payments grow, so do cyber threats; boosting awareness is essential to reduce fraud. The Q&A portion of the event gave students the chance to raise concerns about digital payments, cyber safety and plan their everyday finances. This kind of interactive learning is especially valuable for undergraduates who are just beginning to handle their own banking and digital money flows.

The lecture was organised by Dr Shefal Vaghela, Assistant Professor and Faculty Coordinator at the college. Having a faculty coordinator ensures the event is aligned with students’ needs and curriculum. The idea behind the event was to give students foundational knowledge of banking operations, promote sound money-management habits, and heighten awareness of secure digital transactions. Such efforts tie in with broader goals of financial inclusion and responsible digital behaviour.

Commenting on the session, Shri Adi Rishabh Jain, Vice-President of Swarrnim Startup & Innovation University, said: “Mr Purohit provided clear, practical insights on secure digital banking. The session was well-received by students and played an important role in enhancing their financial awareness in an increasingly digital world.” This acknowledgement underscores the importance of practical, modern financial-education interventions in higher education.

As a result of the lecture, students felt more confident about handling online financial transactions and understood better the importance of financial discipline and digital safety. For young adults entering a financial world full of digital tools, such awareness helps them avoid common mistakes, build a secure foundation for managing money and cultivate habits such as checking account statements, using strong passwords, monitoring transactions and avoiding sharing sensitive data.

In sum, the guest lecture organised by Swarrnim Science College in collaboration with the State Bank of India’s counselling centre responded to a vital educational need. It bridged the gap between academic study and real-world financial skills, helped students engage with banking and digital payment systems, and reinforced the message that in today’s digital age, financial literacy is not optional; it is essential.

Must Read:

Fresh Start With The Orientation Programme At Swarrnim University